Here are a few options to explore:

Xero

Easy to use and made for small business owners. It’s cloud-based, so you can log in from anywhere, send invoices on the go and connect your bank account for quick reconciliations.

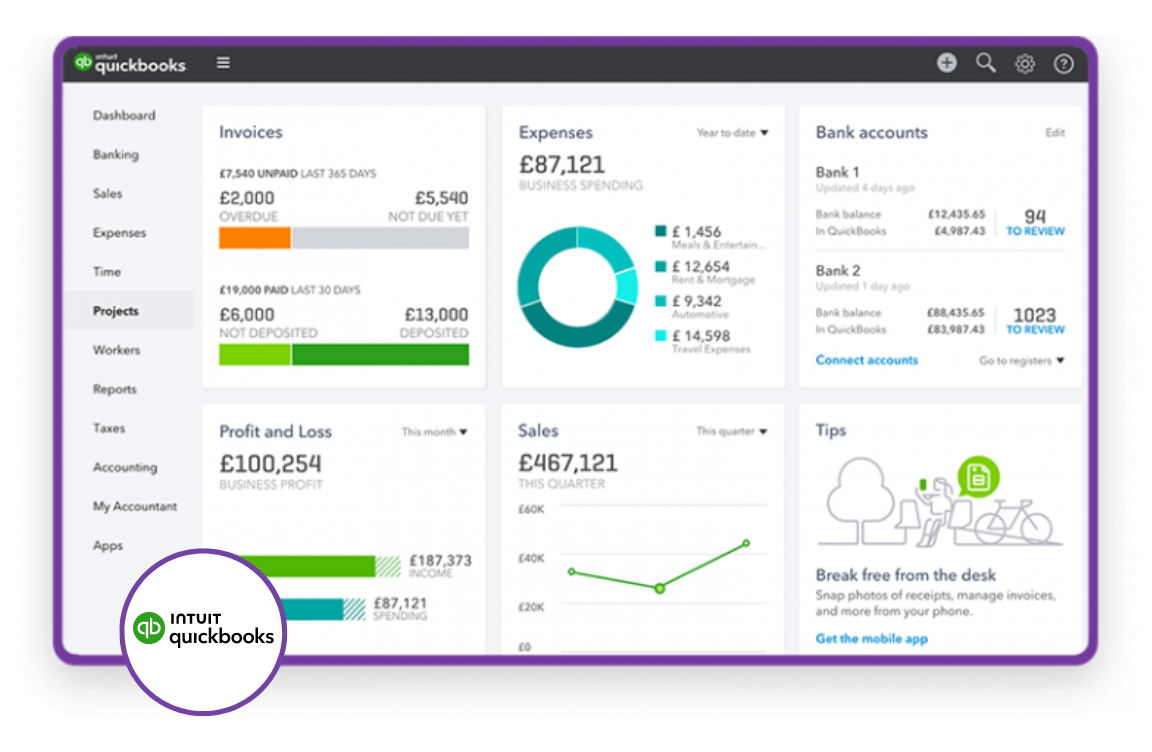

QuickBooks Online

A great option if you want more detailed reports and insights into your cash flow. It’s flexible, user-friendly and grows with you as your business grows.

When choosing, think about what matters most to you. Do you want simple invoicing? More detailed reports? Or payroll for a growing team? Try a free trial first and see what feels like the best fit.

The right software from day one will save you time and headaches later and give you the confidence to focus on running your business.

Ready to make bookkeeping simple? Let’s chat about how we can take this off your plate.

0 Comments